With CFG we took on a project to revamp the FP&A process, with a very simple output a 2024 Budget. To do so a new tool had to be implemented, Planful. I’ll go over what the process looked like, what Planful is, and what I learned along the way. What is…

Blog Category

Info on real estate I’ve learned. I’ve been an investor, contractor, and property manager; I know my way around some good ole properties.

Categories

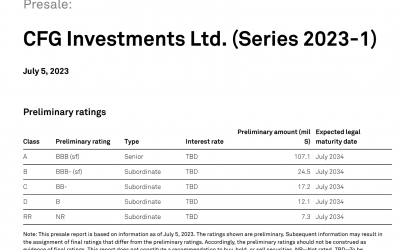

Placing a New Security on the Market – CFG Securitization Refinance

Placing a new security on the securities market is a complex process that involves several key steps. Working through a refinance of the CFG 2021-1 Securitization (referred to as SEC in this blog at times) allowed me to work closely with these key steps and this blog…

The Benefits of Brand Integration for Marketing & How Influencers Tie In

In today’s world, with the rise of digital media, advertising is everywhere. People have become accustomed to tuning out most forms of marketing, which is why brands need to be creative in how they promote themselves. One effective solution is brand integration….

Embrace and Enjoy Criticism – Corporate Guide

Criticism is a topic that is often met with negative connotations and reluctance. However, embracing and enjoying criticism can bring about many benefits that can help individuals grow and improve. Here are some of the key benefits of criticism: Identifying…

How are Currencies Pegged Against the USD

Currencies are pegged against the US dollar (USD) in a number of ways. In general, a currency is pegged to the USD in order to stabilize its value and to make it more attractive to investors and traders. Fixed Exchange Rate System One way that currencies can be…

My Case for Writing on Medium: The Social Place for Blogging

I created a blog on my site to document thoughts, accomplishments, lessons, and opinions. I enjoyed the writing and stuck with it, consuming and creating content. I discovered Medium on accident, but saw the offering and realized a couple items that my writing may not…

Understanding LLMs: How They Work

supported by Notion AI As the field of natural language processing (NLP) continues to grow, the development of language models has become increasingly important. One type of language model that has gained popularity in recent years is the LLM, or the Language…

The Importance of Two-Factor Authentication (2FA)

supported by Notion AI In today’s digital world, security is more important than ever before. With countless online accounts holding sensitive information, it’s vital to ensure that our data is safe from potential threats. One of the best ways to…

Real Estate Investment Trust or REITs

supported by Notion AI A Real Estate Investment Trust or REIT is a company that owns, operates, or finances income-generating real estate. REITs pool money from multiple investors to purchase and manage different types of properties, such as office buildings,…

El Peñón de Guatapé – Rock with a View

El Peñón de Guatapé Guatapé, Antioquia | Colombia 2023 Google Maps Link supported by Notion AI Colombia is a country of natural wonders and stunning landscapes. One of the most popular tourist attractions in the country is El Peñón de Guatapé, a massive…

The Importance of Organized Data

supported by Notion AI Data is an essential asset for every organization, and it is used to make informed decisions across various fields, including business, healthcare, and education. However, data alone is not sufficient to make informed decisions; the…

Simple Explanation of How Investment Bond’s Yields are Measured and How Secondary Markets are Affected

Updated 2023-03-30 Bond yields are significantly affected by monetary policy, specifically FED imposed interest rates. Fed Funds Rate has the effect of changing the overnight lending rate that banks use to borrow and lend money to each other. An increase in the…

Mama’s Tacos | Mexican Restaurant in Miami Beach

4 / 5 stars Great service and tasty food. Really enjoyed everything Anilver recommended and enjoyed. The meat was a little tough, but so flavorful I ate it all. The fish tacos were delicious, best guacamole I’ve had. Would definitely recommend for the tacos. …

Interesting Dynamics of International Finance at CFG Partners

CFG Partners operates in multiple markets in the Caribbean providing loan options to borrowers in their respective markets. CFG gathers some funding for these loans through debt capital markets, using eligible loans as collateral for debt. At the corporate level of…

Finance & Business Terms for Use

Check out this resource on Business and Finance Terms for easy use and reference, made by yours truly on Notion. See Notion Resource Purpose As I’ve worked in various industries and companies I’ve come to notice a common pain point when entering, terminology. I…

Reasons for Remote Work

The evolution of technology has allowed many professions to move towards a remote work environment. This means meetings are done over teams or zooms, and checking in is done via a quick message to your supervisor. Many companies have worked with this model, and some…

What is Owner Occupied Financing

Owner occupied financing refers to when a borrower for a property purchase will be staying and occupying said property. This is a preferred lending option for most lenders and financial institutions, because with the borrower living there they are more likely to…

Loan-to-Value & Combined Loan-to-Value Ratio Basics

Loan-to-Value and Combined Loan-to-Value ratios are used to evaluate the total amount of a property that is encumbered by liens and debt obligations. Understanding how providing a loan to a borrower relates to the value of the property or asset the loan is for shows…

Basics of a Good Debt-to-Income Ratio

When applying for a home loan, the lender is going to do some underwriting to see how much the borrowing can pay and borrow. One important metric is the Debt-to-Income Ratio (DTI). This metric depicts how much debt you have versus the income you make. You can…

“Subject To” Deals 101

When acquiring property there are many financing options beside your traditional mortgage. One unique financing option is the subject to mortgage. This approach has benefits for the buyer, yet you need to ensure it’s the best option for you. A subject mortgage…

Assumption of Mortgage Meaning and Benefits

Assumption of a Mortgage is a unique approach to acquiring property, considered assumption property buying. What happens in this type of transaction, the buyer takes liability, and thus the payments for an existing mortgage. When the seller has a property that…

Basics of Owner Financing Deals

Owner Financing is a unique transaction where the seller of a property finances the purchase directly with the person or entity buying it. This can be for the entire purchase price or a portion of it. One benefit for this arrangement is that it eliminates the bank…

Basics on a HELOC and a Home Equity Loan

Owning property provides you with equity, making it such a great investment. In the case of a home purchase with financing you are building equity over time, through both the property value increase and paying down your loan. With the equity you can secure low cost…

Basics on an FHA Loan

FHA loan stands for Federal Housing Administration, but many mistake it for First Home Application home. The reason is because this type of loan is usually used by first home buyers. This loan is a great choice for people with poor credit or without the…

Intro to Financial Models

A financial model serves the purpose of interpreting financial numbers into a meaningful analysis. While they vary depending on the objective, the information gathered from financial models allows for quality decision making, a better understanding, and a simplified…

What is Web 3

This very popular term is being used a lot to describe anything to do with blockchain, but what is it exactly? In simple terms, Web 3, refers to the next version of the internet that relies on decentralized protocols and uses less centralized companies and providers….

Basics on Blockchain & DLT

Blockchain is a system of recording information that makes it more difficult to change, alter, hack, or cheat the system. In simple terms, blockchain acts as a digital ledger of transactions that is duplicated and distributed across the entirety of the network on the…

“Efforts and courage are not enough without purpose and direction.” – John F.Kennedy

“Efforts and courage are not enough without purpose and direction.” – John F.Kennedy

Feeding South Florida, helping a great organization through volunteering

Link to their website: https://feedingsouthflorida.org/ I started working with Feeding South Florida in late 2021, and have been a part of their volunteer staff since. I enjoy working with organizations that provide immediate impact, whether through donations,…

“Live as if you were to die tomorrow. Learn as if you were to live forever.” – Mahatma Gandhi

Changes to work in a post pandemic world for networking, sales, & business activities

Seeing how Covid-19, quarantine, and health concerns have changed the way traveling for business needs; is something that has never been seen before in this digital modern world. While there definitely was an adjustment period, business seems to be proceeding in a new…

Grand Canyon – Mother Nature Showing Off

Grand Canyon National Park Arizona | United States 2021 Google Maps Link A humbling sight, so massive and magnificent. It was great to see locals enjoying themselves, very polite. As far as the eye could see you see the grand canyon. Something…

Sedona – A Place of Beautiful Energy & Views

Sedona Arizona | United States 2021 Google Maps Link Red rocky desert dirt never looked so good like in Sedona. Home to Vortex’s and UFO sightings, this place was full of peace, serenity, power, and life. Besides hiking, and exploring, picture’s do it more…

Flagstaff – A Mountain Landscape Full of Beauty & Peace

Flagstaff Arizona | United States 2021 Google Maps Link A Florida-raised person like myself isn’t around much altitude So naturally I had to visit Flagstaff, an area known for its mountain landscape, to get myself somewhere a little out of my element. It’s one…

Montezuma Castle National Monument – History & Science Galore

Montezuma Castle National Monument Arizona | United States 2021 Google Maps Link An ancient well preserved cliff dwelling, located in North America (Arizona). They resemble apartments in a way, just built into the limestone cliff. Here there was a flourishing…

UTV Riding – Desert, Mud, & Scenery in Arizona

UTV Riding in New River Arizona | United States 2021 Arizona Outdoor Fun Tours and Adventures An excursion like no other, this was a great time, the funniest thing I’ve done on this trip. This was a guided tour with a leader in the front of the group and us (Rocio…

Apache Trail – Beautiful Scenic Trail in the Mountains

Apache Trail Arizona | United States 2021 Google Maps Link A beautiful scenic drive that took a whole day to navigate but was full of fun and exploration. This trail that goes into the Superstition Mountains is full of scenic views, history, and nature like no…

Pros of a Wide Curved or Dual Screen Monitor Set Up

If you’re considering getting a dual screen monitor or an ultra-wide monitor, do it. This is the one I use: Ultra-wide Monitor I highly recommend doing so, my efficiency has tripled since then. How to choose between the two is really up to preference, but first…

Working with SPEED from FAU | Electric Racing Team

SPEED is an electric car racing team that is focused on creating an Electric Race Car to place in competitions in Florida. One of the first and only teams (universities) in Florida to be pursuing this. Overall Experience and Focus I was very fortunate to be…

Robinhood, A Preferred Trading Brokerage

Robinhood, A Preferred Trading Brokerage In short, my preferred #1 brokerage I use is Robinhood. It definitely gives me the most bang for my buck, since it offers commission free transactions and then some! Commission Free Transactions Optional Cash High-Yield Savings…

Wekiwa Springs State Park – Nature & beauty in a swamp

Wekiwa Springs is an amazing place to kayak and unwind. Once you’re there all you see is Florida’s natural wetland beauty. Able to experience it both with clear skies that on occasion turned rainy (Florida’s infamous bipolar climate), we got to see all walks of life. ..…

Pompeii – City under a volcano

Pompeii Historic city of Naples | Italy 2019 Google Maps Link A historic city under the active volcano of Vesuvius that was buried by an eruption around 79 A.D.. These ruins provide a glimpse into the ancient life of humans back then. On the way there we were…

Rome – The historic capital city of Italy

Rome Capital city | Italy 2019 Google Maps Link If cities could talk, this city could tell tales for ages. This city is unique, where once a time period has passed the city was rebuilt, with the new city added on the rubble and rock of he previous. Each layer…

Tivoli – Historic town full of natural beauty

Tivoli Town & commune | Italy 2019 Google Maps Link A small town nestled in the natural Italian landscape. An old city dating back to the roman age, this town is full of history and natural beauty. Located beneath the falls of the Aniene river it even has a…

Vatican City – A masterpiece of a city

Vatican City A city-state in Europe | Italy 2019 Google Maps Link This city was a masterpiece in it’s entirety, a lot of details everywhere from the tall immense building down to the water fountains. As the headquarters of the Roman Catholic Church it…

Venice – A gorgeous town built on the water

Venice Metropolitan City of Venice | Italy 2019 Google Maps Link “Venezia” in Italian, this entire region is made of canals & built on longs right on the water. Being on the water the main form of transportation are water taxis, with different…

Cueva del Indio – Cliff view like no other

Cueva del Indio Cave (Cueva del Indio) Public Park in Las Piedras | Puerto Rico 2018 Google Maps Link Puerto Rico is a breathtaking island, completely surrounded by water, and this cliff view was like no other. The water looked so blue and inviting, my natural…

Viejo San Juan – The popular historic area of PR

Viejo San Juan Historic section of the Capital City | Puerto Rico 2018 Google Maps Link The city was so nice and the area had some of the best weather I have ever felt. Perfect humidity and sunlight I could definitely live here solely on water alone. Next time…

Working with Real-T | Real Estate Tech Start-Up

Real-T was a start-up company that was focused on creating applications that would improve workflows for the Real Estate Industry. I was connected with them through Mr.Cox a professor at FAU. I worked and interned with the Real-T team for a semester and was able to…

Chichen Itza – Ancient city ruins, super fun to explore

Chichen Itza Excavated ruins | Mexico 2017 Google Maps Link These ruins were breathtaking to see. Super large and extensive after hours exploring I only scratched a portion of these ruins. It was impressive now, to imagine it back when these ruins were cities…

Taboga Island – Fun island full of natural beauty

Panama City Island | Panama 2017 Google Maps Link This island was so much fun to see and explore. The best part about the island was how “untouched” it was. No big resorts or human infrastructure present, this island is full of rich jungle and…

Panama City – Underappreciated city with its own waterways

Panama City Capital city | Panama 2017 Google Maps Link This amazing city (and country) is grossly underrated. The city was very modern and busy, full of people either playing soccer at the parks or conducting business from building to building. The hustle and…