CFG Partners operates in multiple markets in the Caribbean providing loan options to borrowers in their respective markets. CFG gathers some funding for these loans through debt capital markets, using eligible loans as collateral for debt.

At the corporate level of CFG where the debt capital market’s team, including myself, reside; we work with funding and maintaining the Special Purpose Vehicles for their respective markets.

On the other hand the consumer is seeing another side of CFG, getting a loan through a subsidiary brand.

While in Puerto Rico in 2022 I saw one of the local banks that CFG uses to manage funds for the business. This got me thinking about all the moving pieces that are involved with my line of work.

In this post I’ll go over some of the moving pieces of CFG and some interesting finance dynamics I’ve noticed with CFG Partners.

Foreign Market and it’s Borrowers

To start I’ll focus on one market that CFG is involved in, Aruba.

A large consumer base is present there, and we’ll go step by step, starting with the consumer point of view on getting a loan.

Island Finance, CFG’s consumer facing brand

When someone in Aruba needs a loan they will go to financial institutions and here they are introduced to Island Finance, a CFG subsidiary brand.

The ideal customer for Island Finance is someone with a long term job, stable income, and ability to pay. Loans with Island Finance are based mainly on a customer’s ability to pay, so the available loan amount depends directly on the income of the borrower.

After review and underwriting they are provided the loan by Island Finance.

Local Bank, how we take in and manage funds

Depending on the loan, consumers make payments for their loans directly from their paycheck or in branch. These payments are deposited into a collections account, which are then moved into a Special Purpose Vehicle account, SPV for short.

Loans Moving into a SPV

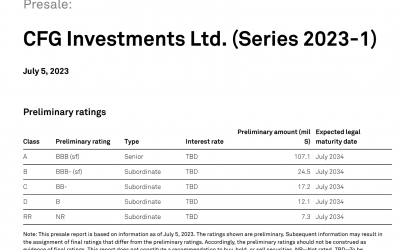

In debt capital markets, companies get funding through investors and use securitized loans (accounts receivables, assets) as collateral.

Usually there are special purpose vehicles put in place so the lender is assured that funds for the collateralized debt is kept allocated for the securitization. Through net settlements we assure that collections from collateralized loans are placed properly.

Getting Funding and Using Loans as Collateral

As CFG with its subsidiary brands continue to provide and service new loans, we maintain collateral levels and cash to continue doing what CFG does best.

We may pledge more loans as collateral to release cash in SPV accounts to then provide more loans. Likewise we can use loans for other facilities as well, to acquire funding or paydown debt.

In Conclusion

Working in debt capital markets involves a lot of moving pieces and is more nuanced than you know. I hope this simplified breakdown provides a little insight into some of the work involved in managing facilities and securitizations.

If you want to learn more about CFG Partners I recommend you check their site here: https://cfgpartners.com/